The article was updated on May 09, 2022.

Since smartphones have become embedded in our daily life, we have been striving to use them to make our existence as convenient and productive as possible. Technology trends in finance have transferred nearly every facet of our financial procedures to fintech apps. The pandemic contributed largely to this shift. This tendency opens up rich fintech startup opportunities for those who want to get into app development.

In this article, we will take a closer look at the fintech startup app ideas to consider in 2022 and beyond, talk about the main fintech app features and the step-by-step process of fintech app development. But first, let’s make a brief overview of the current fintech market situation.

Fintech market overview

It’s no secret that the COVID-19 outbreak has accelerated the adoption of some of the most promising fintech technology trends. For some finance industry players, shifting to a digital-only format became paramount to survival. Established financial companies, previously reluctant to embrace innovations, are now competing with startups and are building fintech apps.

As per the ResearchAndMarkets report, the fintech app market size will reach $305 billion by the year 2025, growing at a 20% CAGR. Fintech is now among the fastest-growing industries worldwide, as the COVID-19 crisis has opened the doorways to numerous business opportunities.

As per the recent fintech app industry overview published by Finch Capital; loans, lending platforms, mortgages, and life insurance services are the indisputable winners both among fintech startups and established financial market players.

As we head towards the post-crisis recovery, the finance market’s incumbents will be increasingly embracing digitization and confidently competing with fintech startups.

The trends in fintech technology

In a nutshell, AI, IoT, and blockchain will continue to be at the forefront of fintech transformation. However, the technologies surrounding fintech app development deserve a closer look.

1. Artificial Intelligence

Of all the innovations disrupting fintech, AI is deemed the most significant. In fact, Research and Markets predict that the global market for AI in fintech will reach 22.6 billion USD by 2025.

Fintech apps use AI to automate routine operations, offer personalized financial advice, detect fraudulent activity, and analyze high volumes and varieties of data for insights. In many respects, AI in fintech is still an emerging technology, and its full potential is yet to be uncovered.

Read also: How Fintech Startups Can Take Over the Market with AI and IoT

2. Big data

Big data and AI are tightly interconnected. Electronic devices leave a digital footprint in the form of miscellaneous data that fintech apps aggregate and submit for analysis. AI algorithms then process this data to transform it into valuable insights about new business opportunities, customer behavior and market trends.

3. Blockchain

Blockchain is the electronic distributed ledger. The ‘blocks’ in the ‘chain’ contain batches of data that, assembled together, represent a single entity. The data stored in a blockchain doesn’t reside on any centralized server, it is distributed across the entire blockchain network. This ensures the security and integrity of financial transactions since there is no central node that hackers can attack.

4. Data security

Cybersecurity is paramount to developing a fintech app. When it comes to protecting highly-sensitive financial data, conventional means don’t apply: fintech startups have to leverage sophisticated technologies like Source Code Analytics, penetration testing, and the DevSecOps approach to protect customers’ information.

Moreover, as per the EU GDPR Law, fintech companies have to prove their commitment to safeguarding user data and do all it takes in order to avoid security threats like malware attacks and identity theft.

5. Microservices

Microservice technology is a way to architect an app as a combination of interconnected services. One sure advantage of microservices is that you can easily add a service without disrupting the entire app structure. Microservice technology complements AI and blockchain and helps reduce the cost of building a fintech app.

6. Voice-enabled payments

Digital finance management doesn’t mean staring at your device and spending time typing and finding information. Natural language recognition, processing, and generation are powerful trends in fintech that allow you to get info about your balance and make transactions even without picking up the phone.

With voice-enabled payments, your fintech startup will win even more clients, as voice assistants contribute to users’ convenience.

7. Biometric technology

The future of fintech relies immensely on biometric authentication methods. It’s among today’s foremost fintech trends, but in the coming years, face or voice recognition and fingerprint scanning will surely be basic security features.

The next methods to surprise your clients may be palm vein patterns or iris recognition options. The beauty of biometric technology lies in the combination of impenetrable data protection and login simplicity.

8. Open banking

Once you have learned what open banking is, you can instantly take your fintech startup closer to the niche leaders. That is because by using third-party APIs, you can offer even more opportunities for your customers, making their experience seamless.

For instance, thanks to open banking, we can use one bank account for making payments on other platforms and enjoy personalized recommendations.

9. Virtual cards

Bank cards have the prospect of fully replacing cash payments. But furthermore, cards will probably go digital, making transactions as convenient as possible.

Your fintech startup can leverage the power of VISA- and Mastercard-based virtual cards to simplify for your clients both everyday payments and complex investments, up to cryptocurrency transactions.

10. Gamification

You have probably heard about gamification as a tactic for increasing a client’s emotional engagement. However, as a fintech trend, you can use a game-like design for helping users reach their financial goals or develop healthy money habits.

For instance, you can assist your clients in tracking their spending and savings or offer cashback reward programs.

Fintech app ideas for fintech startups

If you’re thinking about building a fintech startup, the time is ripe. As the pace of post-crisis digitization accelerates, early adopters of fintech app solutions will be in a better position than the laggards.

Regardless of whether you are an established financial company planning a digital shift or a novice, here are some of the fintech startup app ideas to consider in 2022.

1. Lending apps

The economic downturn caused by the COVID-19 lockdown caused many organizations and individuals to look for quick loans to provide for their needs.

Powered by AI and big data analytics, lending apps simplify the loan assignment process by analyzing customer data, behavior patterns, credit history, and shopping activity to indicate if a customer qualifies for a loan. The money borrowed with lending apps may come from banks or peer-to-peer lending (i.e. borrowing money from other individuals).

MoneyLion is a great example of a lending and savings fintech app. The app also helps users manage their personal finances, has great testimonials and a steadily growing user base.

2. Electronic mortgage apps

Initially, the COVID-19 crisis had negatively impacted the mortgage market making it harder for people to get a mortgage. As the world began to recover from the crisis, the mortgage rates have dropped, and the newly emerged e-mortgage apps have simplified the mortgage application process. E-mortgage apps now offer contactless mortgages which are likely to become a new standard after the COVID-19 outbreak.

Some of the best 2020 mortgage apps include Better.com, an app for purchasing homes and recalculating existing mortgages.

Another example of an excellent app in this segment is FairwayNow, which is targeted at obtaining home loans from the government.

3. Insurtech apps

Because of the global pandemic, we are witnessing a surge in new fintech apps focusing on affordable insurance plans. Insurtech apps use AI and data science to collect, process, and evaluate the customer data, identify the risks involved and facilitate the insurance underwriting process. Using fintech app solutions, insurance companies can accelerate operations and boost the quality of their customer service.

The apps in this segment target different insurance domains. myCigna, for example, is an app built by Cigna, a global health insurance company, helping customers claim health insurance and keep track of their healthcare expenses.

Allstate Mobile is a car insurance app enabling users to quickly submit insurance claims and is packed with loads of other useful features for car owners.

Read also: Software Solutions for Insurance Companies: Best Practices

4. Mobile banking apps

Today, customers turn to digital banking to get quick and hassle-free access to banking services. High market demand has set the stage for the emergence of digital-only banks, such as Ally Bank, and the need to maintain social distancing has made them the best option during the crisis.

Traditional banks such as Wells Fargo, Bank of America, and Huntington Bank have also built namesake mobile banking apps and are competing with newcomers.

Typically, a fintech banking app grants users digital access to operations like closing and opening accounts, deposits, making online transactions, ordering credit cards, etc. It also integrates AI chat bots for a quick consultation and financial advice.

Read also: Explained: How to Create a Secure Mobile Banking App

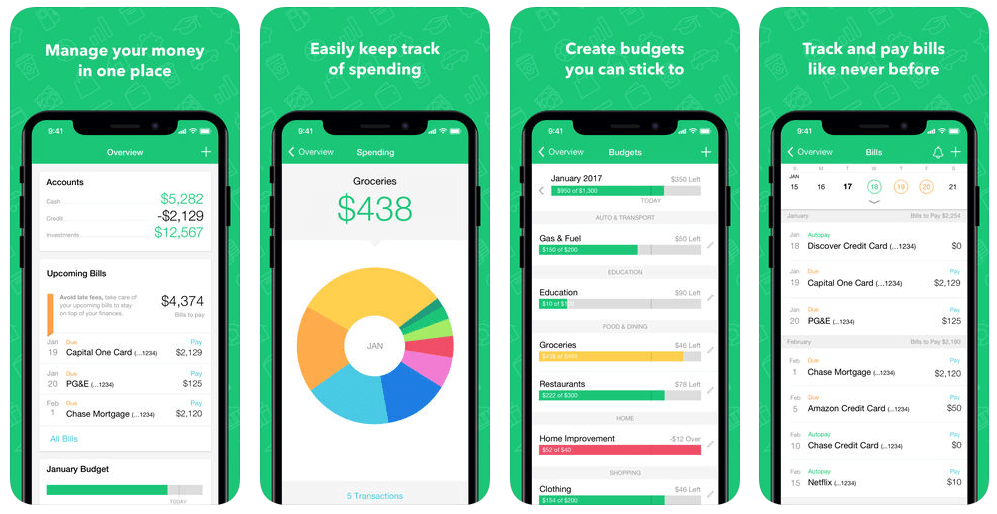

5. Personal finance apps

For most people out there, managing personal finance, let alone savings and investments, remains a challenge. We’re not born financially literate, and financial advice services remain some of the top fintech startup app ideas. Today, robo-advisers offering assistance on investments, retirement, and savings are gradually becoming mainstream.

Apps like Mint bring customers a holographic view of their finances, including loans, credit card accounts, and investments.

Read also: What Are the Best Personal Finance Apps and How to Build One?

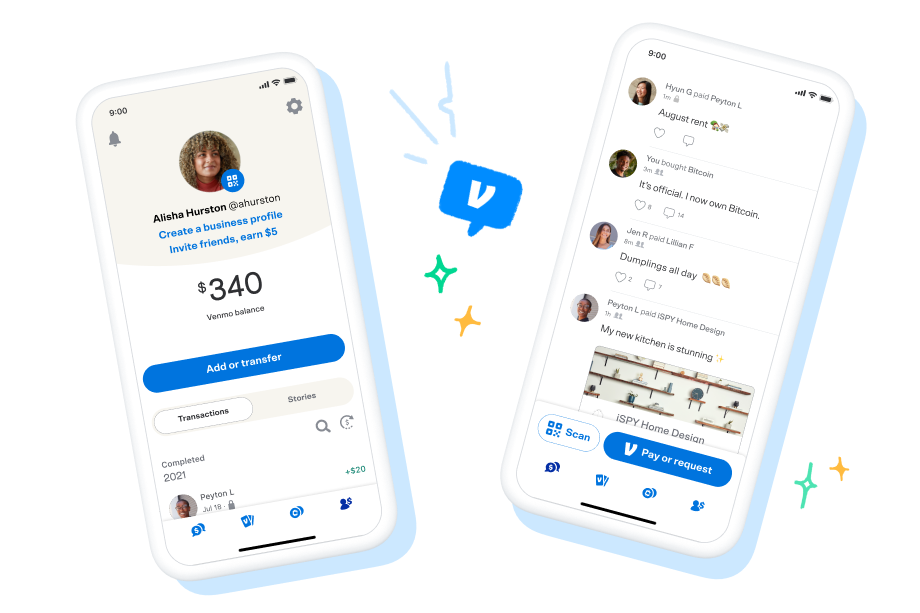

6. Peer-2-Peer payment apps

You might want to consider peer-2-peer payment apps if you’re looking for fresh fintech ideas. These apps are meant for transferring money between individuals: for example, between friends and relatives. The money from the customer’s account gets transferred directly into the recipient’s electronic wallet. Today’s peer-to-peer payment apps are connected with banks, digital wallet services, or standalone payment services like PayPal.

If you’re thinking how to create fintech apps for P2P payment, take a closer look at Venmo and Zelle. While Zelle transfers money to friends and family, Venmo also works with select online retailers.

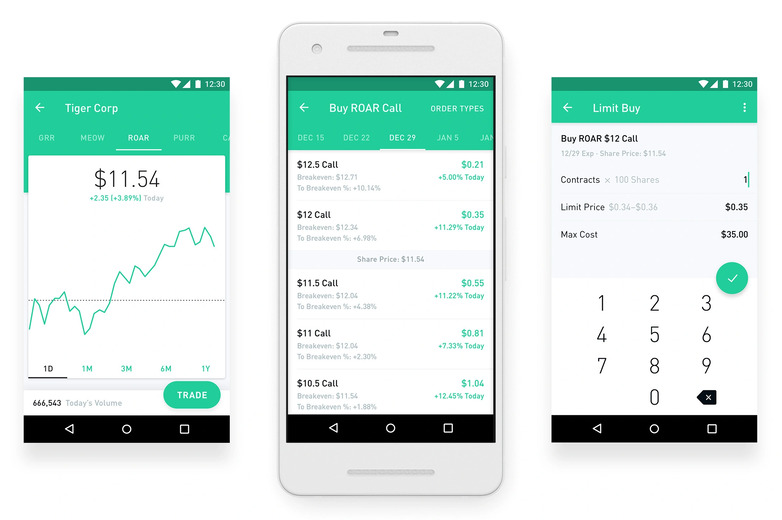

7. Trading and investment apps

Apps for stocks and assets trading are some of the hottest fintech app trends on today’s financial scene. Trading and investment apps use a mix of blockchain, AI and Machine Learning to radically improve trading outcomes. Algorithmic trading eliminates human error and emotional factors, makes smart decisions based on data, instantly reacts to the changing market situation and enables traders to trade from multiple accounts all at once.

Read also: Stock Market Apps: Tips to Build a Trading Platform Step by Step

AI and data analytics help users get quick insights about potential investments and make informed decisions. Many trading and investment apps, including robo-advisors, are helping users learn investment and trading.

One of the trading apps quickly winning the US market is Robinhood. This app for investment and stock trading is estimated to cost over $7.5 billion.

8. Crowdfunding apps

If you’re brainstorming fintech ideas, consider building a startup for other startups. Crowdfunding apps help budding entrepreneurs raise money for their initiatives. They also provide them with invaluable proof-of-concept capabilities: by posting their startup idea on a crowdfunding platform, they can quickly see if investors are interested. Surely, Kickstarter has the larger user base in this app segment, and can be an excellent example of a top-notch crowdfunding app.

There are select niches, however, that have their designated apps for crowdfunding purposes: Patreon, for example, helps creative professionals crowdfund their content, while Causes targets non-profit campaigns and endeavors.

9. Regtech apps

Alternatively, you may build an app for helping businesses comply with laws and regulations and eliminating risks associated with regulatory issues. Monitoring new regulations, identifying risks, running compliance checks and translating requirements into concrete steps that companies have to take to avoid penalties are what regtech apps are built for.

Cappitech is an Israeli fintech startup that automates the creation and submission of regulatory reports. Regtech apps also help businesses keep an eye on their data security.

Dathena, a fintech startup based in Singapore, offers enterprises a set of tools for automating the implementation of security policies and safeguarding data.

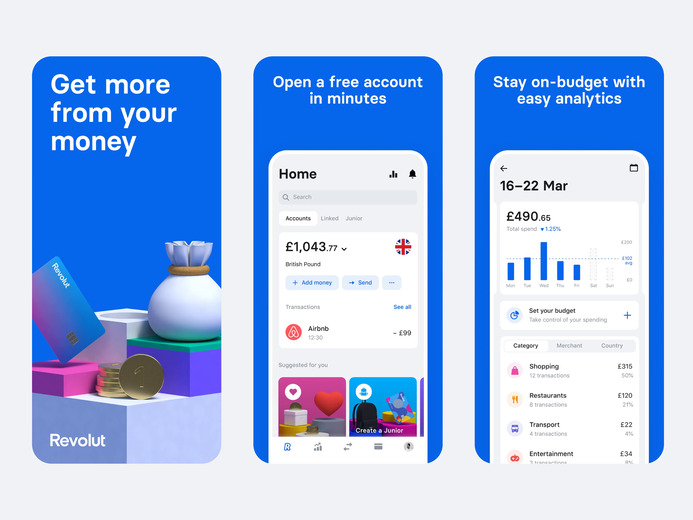

10. Digital payment apps

Also, you may try to tap into the niche of digital payments. This segment is already a bit crowded, but quick and risk-free money transfers remain in high demand. Electronic wallets, digital money, apps for transferring money from buyers to vendors, and international money transfers fall into this category.

Revolut, for example, will help you transfer money to most countries, and in over 150 currencies, including crypto-currencies.

11. Cryptocurrency apps

Finally, consider using the advantages of blockchain to build an app for cryptocurrency trading. Cryptocurrencies are digital assets stored in a distributed ledger.

An example of such apps is Coinbase, the world’s top app for trading currencies like Bitcoin, Ethereum, and Litecoin with a built-in wallet for digital money.

Apart from cryptocurrency trading, examples of using blockchain in fintech include

- money transfer,

- money lending,

- insurance claims processing,

- asset management, etc.

The security and the guaranteed information integrity of blockchain apps can become a major advantage.

12. Bill reminder apps

A bill reminder app is a simple yet prospective fintech startup idea. Usually, monthly bill tracking appears to be a separate feature of a personal finance app. However, you can transform this function into a standalone app for those who find it difficult to manage all their regular payments such as rent, electricity, water, or phone bills. With that said, a monthly bill tracker is a perfect solution for users with busy schedules.

Prism is an outstanding example of a successful bills reminder app. Apart from having the basic functions of a fintech app such as analyzing all your balances in one place, Prism embodies all the benefits of bill tracking apps. Just schedule your bills, and the app will add them to a calendar and notify you about the upcoming payment.

13. Digital wallet apps

Want to develop a platform that will always be close at hand for your clients? Create a digital wallet app! People appreciate the opportunity to keep all their bank card data in one place and pay for anything in a matter of seconds. A digital wallet app can replace both cash and physical credit cards, but it may also be attractive due to the potential added value of combining lucrative options such as coupons and cashback bonuses.

You have probably come across PayPal before. It’s among the most widely known digital wallets which allow people to make seamless transactions across the globe. Millions of users prefer PayPal because they are sure their data is fully protected, and they can make any payment in only a couple of clicks.

Take a look at our fintech portfolio here.

Common features for fintech apps

Most fintech apps share a lot of common features. Your app doesn’t have to be 100% unique: sometimes all it takes is better user experience and some additional features to successfully compete with other app market players.

Sign-in

Users should be able to sing in smoothly and effortlessly, yet, with all the necessary security precautions. Two-factor authentication is a must, and a good idea would be to complement it with face and fingertip recognition. Using biometrics for sign-in will soon become a universal standard.

Quick scan feature

One of the most daunting features in smartphone usage is having to input data manually or on the go when you need to take quick action. In this regard, card number and QR code scanning goes a long way in creating a great user-experience.

Custom notifications

Custom notifications offer users an enhanced level of personalization by enabling them to choose which info they want to receive. Granting them the freedom to unsubscribe from annoying alerts will surely make your app more user-friendly.

Cashback

Cashbacks are must-haves for many payment apps. The more payments users process with your app, the more cashbacks they receive. This feature will account for higher customer retention rates, so make sure you implement it as you create a fintech app.

AI bots and assistants

Instant customer support is what your users get when you include a virtual-assistant or a chatbot into your fintech application. You also rid your customer support service from excessive workloads. There’s another reason why customers love chatbots and robo-assistants: they offer quick answers to questions without the stress of human interaction.

Third-party services

Building an app tightly packed with features may actually backfire on fintech startup owners: sometimes users want a plain and simple app that won’t cause “tool fatigue”. However, some third-party services may be highly relevant. For example, ordering food, buying groceries or airplane tickets could be important options to include into a consumer payment app.

Regardless of which app you choose to build, make sure it includes the basic feature set typical of your fintech app niche. This will enable you to reduce user churn and your customers won’t have to turn to any other company for essential services.

Bottom line

The future of fintech looks brighter than ever, yet, building a fintech app is by no means an easy task. Normally, the app development process starts with the ideation stage when you write detailed specifications for your future app in collaboration with your development partner.

If you’re contemplating how to create a fintech app, contact us now and our experts at Xcoder will give you a free consultation.

From writing an app specification to all-inclusive technical and marketing support, our team will guide you through every step of the app development process.

Frequently Asked Questions

How to develop a fintech app?

Typically, building a fintech app includes 10 steps:

- Choosing a fintech niche

- Ensuring regulatory compliance

- Refining your app concept

- Writing app specification

- Designing attractive UI/UХ

- Choosing the tech stack

- Estimating development costs and timeline

- Building an MVP

- Developing and launching your app

- Committing to ongoing upgrade, promotion and support

What are the best programming languages to build a fintech app?

The most widely used programming languages for fintech apps are:

- Java

- Python

- C++

- C#

- Ruby

How to find a good app developer with fintech experience?

- Look for relevant expertise and skill sets

- Leverage recruitment automation

- Access soft skills

- Start with a short-term project to test drive your cooperation

Alternatively, partner with an outsourcing provider with a wide talent pool and advanced recruitment techniques. Consider team augmentation and distributed team models to bridge the fintech talent gap.

What are the major features of fintech applications?

Most fintech apps, regardless of their market segment share the common basic features:

- Secure sign-up using face recognition, biometrics and two-factor authentication

- Basic niche-specific operations

- QR code scanning

- Third-party integrations

- AI bots and assistants

- Custom notifications

How to secure a fintech application?

- Use data encryption, access policies, DLP features and backup systems to prevent data leakage

- Use biometrics and two-factor authentication, reliable password policies, credit and identity monitoring to prevent identity theft

- Use AI, ML and DPI firewalls to detect and prevent malware attacks

- Use only trusted cloud service providers and implement strong cloud security policies

- Prevent compromise of APIs with API access authentication and other relevant measures

Read also: